Advertisement

-

Published Date

March 20, 2022This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

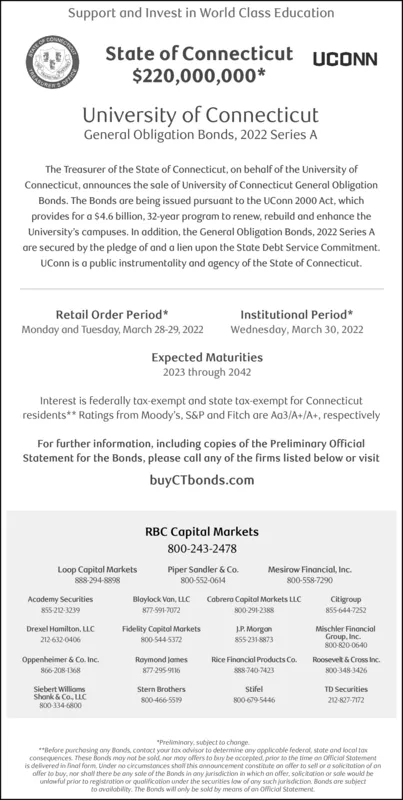

Support and Invest in World Class Education State of Connecticut UCONN $220,000,000* University of Connecticut General Obligation Bonds, 2022 Series A The Treasurer of the State of Connecticut, on beholf of the University of Connecticut, announces the sale of University of Connecticut General Obligation Bonds. The Bonds are being issued pursuant to the UConn 2000 Act, which provides for a $4.6 billion, 32-yeor program to renew, rebuild and enhance the University's campuses. In addition, the General Obligation Bonds, 2022 Series A are secured by the pledge of and a lien upon the Stote Debt Service Commitment. UConn is a public instrumentality and ogency of the Stote of Connecticut. Retail Order Period* Institutional Period* Monday and Tuesday, March 28-29, 2022 Wednesday, March 30, 2022 Expected Maturities 2023 through 2042 Interest is federally tax-exempt and state tax-exempt for Connecticut residents** Ratings from Moody's, S&P and Fitch are Aa3/A+/A+, respectively For further information, including copies of the Preliminary Official Statement for the Bonds, please call any of the firms listed below or visit buyCTbonds.com RBC Capital Markets 800-243-2478 Loop Copital Markets 888-294-8898 Piper Sandler & Co. 800-552-0614 Mesirow Financial, Inc. 800-558-7290 Acodemy Securities Blaylock Van, LLC Cobrero Copital Morkets LLC Citigroup 855-6447252 855-20-3219 87-591-7072 800-291-2388 Fidelity Copital Markets s00 544 S372 JP. Morgan 855 231 8873 Drexel Homilton, LLC Mischler Financiol Group, Inc. 800-20-0640 212 632-0406 Roymond Jomes 877-295 916 Oppenheimer & Co. Inc. Rice Financial Products Co. Roosevelt & Cross Inc. 866 208 368 S8s-740 7423 800 348 3426 Siebert Willioms Stern Brothers Stifel TD Securities Shonk & Co. LLC 800-134 800 212 827-7172 800-466-559 s00 6795446 "Preliminory, subject to change "Before purchasing ony Bonds, contoct your tox odvisor to determine any opplicable federal., stote and local tax consequences. These Bonds may not be sold nor moy offers to buy be accepted, prior to the time an Official Stotement is delivered in finol form. Lnder no circumtonces shol this announcement coristitute on offer to sell or e solicitation of an offer to buy, nor sholl there be ony sale of the Bonds in ony jurisdiction in which an offer, solicitation or sale would be unlowful prior to registrotion or qualificobon under the securilies low of ony such jurisdiction Bonds are subject to ovailability. The Bonds will only be sold by meons of on Official Stotement Support and Invest in World Class Education State of Connecticut UCONN $220,000,000* University of Connecticut General Obligation Bonds, 2022 Series A The Treasurer of the State of Connecticut, on beholf of the University of Connecticut, announces the sale of University of Connecticut General Obligation Bonds. The Bonds are being issued pursuant to the UConn 2000 Act, which provides for a $4.6 billion, 32-yeor program to renew, rebuild and enhance the University's campuses. In addition, the General Obligation Bonds, 2022 Series A are secured by the pledge of and a lien upon the Stote Debt Service Commitment. UConn is a public instrumentality and ogency of the Stote of Connecticut. Retail Order Period* Institutional Period* Monday and Tuesday, March 28-29, 2022 Wednesday, March 30, 2022 Expected Maturities 2023 through 2042 Interest is federally tax-exempt and state tax-exempt for Connecticut residents** Ratings from Moody's, S&P and Fitch are Aa3/A+/A+, respectively For further information, including copies of the Preliminary Official Statement for the Bonds, please call any of the firms listed below or visit buyCTbonds.com RBC Capital Markets 800-243-2478 Loop Copital Markets 888-294-8898 Piper Sandler & Co. 800-552-0614 Mesirow Financial, Inc. 800-558-7290 Acodemy Securities Blaylock Van, LLC Cobrero Copital Morkets LLC Citigroup 855-6447252 855-20-3219 87-591-7072 800-291-2388 Fidelity Copital Markets s00 544 S372 JP. Morgan 855 231 8873 Drexel Homilton, LLC Mischler Financiol Group, Inc. 800-20-0640 212 632-0406 Roymond Jomes 877-295 916 Oppenheimer & Co. Inc. Rice Financial Products Co. Roosevelt & Cross Inc. 866 208 368 S8s-740 7423 800 348 3426 Siebert Willioms Stern Brothers Stifel TD Securities Shonk & Co. LLC 800-134 800 212 827-7172 800-466-559 s00 6795446 "Preliminory, subject to change "Before purchasing ony Bonds, contoct your tox odvisor to determine any opplicable federal., stote and local tax consequences. These Bonds may not be sold nor moy offers to buy be accepted, prior to the time an Official Stotement is delivered in finol form. Lnder no circumtonces shol this announcement coristitute on offer to sell or e solicitation of an offer to buy, nor sholl there be ony sale of the Bonds in ony jurisdiction in which an offer, solicitation or sale would be unlowful prior to registrotion or qualificobon under the securilies low of ony such jurisdiction Bonds are subject to ovailability. The Bonds will only be sold by meons of on Official Stotement