Advertisement

-

Published Date

March 20, 2025This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

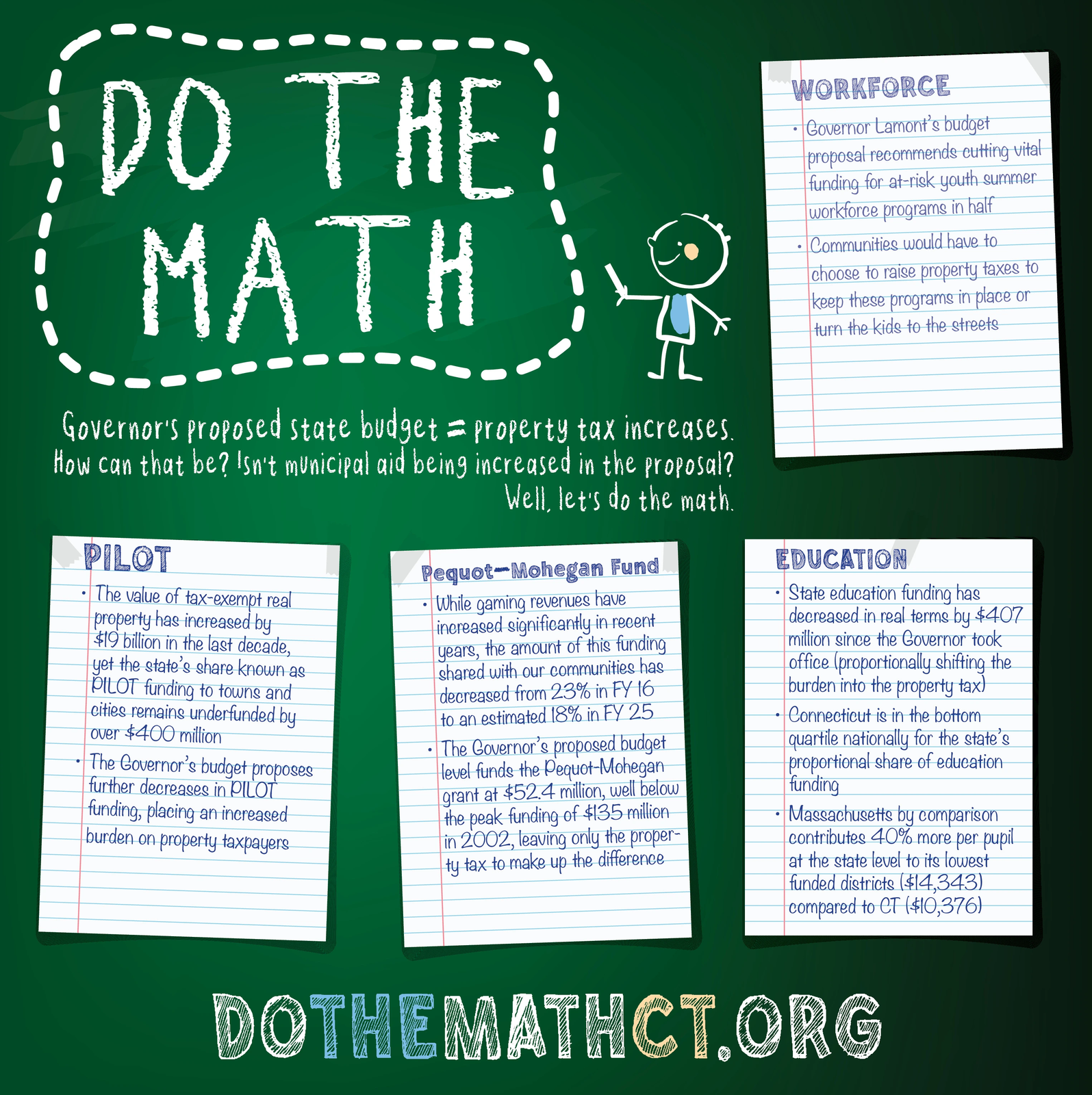

DO THE MATH Governor's proposed state budget = property tax increases. How can that be? Isn't municipal aid being increased in the proposal? PILOT The value of tax-exempt real property has increased by $19 billion in the last decade, yet the state's share known as PILOT funding to towns and cities remains underfunded by Over $400 million The Governor's budget proposes further decreases in PILOT funding, placing an increased burden on property taxpayers Well, let's do the math. Pequot-Mohegan Fund While gaming revenues have increased significantly in recent years, the amount of this funding shared with our communities has decreased from 23% in FY 16 to an estimated 18% in FY 25 The Governor's proposed budget level funds the Pequot-Mohegan grant at $52.4 million, well below the peak funding of $135 million in 2002, leaving only the proper- ty tax to make up the difference . WORKFORCE Governor Lamont's budget proposal recommends cutting vital funding for at-risk youth summer workforce programs in half Communities would have to choose to raise property taxes to keep these programs in place or turn the kids to the streets EDUCATION State education funding has decreased in real terms by $407 million since the Governor took office (proportionally shifting the burden into the property tax) Connecticut is in the bottom quartile nationally for the state's proportional share of education funding Massachusetts by comparison contributes 40% more per pupil at the state level to its lowest funded districts ($14,343) compared to CT ($10,376) DOTHEMATHCT.ORG DO THE MATH Governor's proposed state budget = property tax increases . How can that be ? Isn't municipal aid being increased in the proposal ? PILOT The value of tax - exempt real property has increased by $ 19 billion in the last decade , yet the state's share known as PILOT funding to towns and cities remains underfunded by Over $ 400 million The Governor's budget proposes further decreases in PILOT funding , placing an increased burden on property taxpayers Well , let's do the math . Pequot - Mohegan Fund While gaming revenues have increased significantly in recent years , the amount of this funding shared with our communities has decreased from 23 % in FY 16 to an estimated 18 % in FY 25 The Governor's proposed budget level funds the Pequot - Mohegan grant at $ 52.4 million , well below the peak funding of $ 135 million in 2002 , leaving only the proper- ty tax to make up the difference . WORKFORCE Governor Lamont's budget proposal recommends cutting vital funding for at - risk youth summer workforce programs in half Communities would have to choose to raise property taxes to keep these programs in place or turn the kids to the streets EDUCATION State education funding has decreased in real terms by $ 407 million since the Governor took office ( proportionally shifting the burden into the property tax ) Connecticut is in the bottom quartile nationally for the state's proportional share of education funding Massachusetts by comparison contributes 40 % more per pupil at the state level to its lowest funded districts ( $ 14,343 ) compared to CT ( $ 10,376 ) DOTHEMATHCT.ORG