Advertisement

-

Published Date

September 19, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

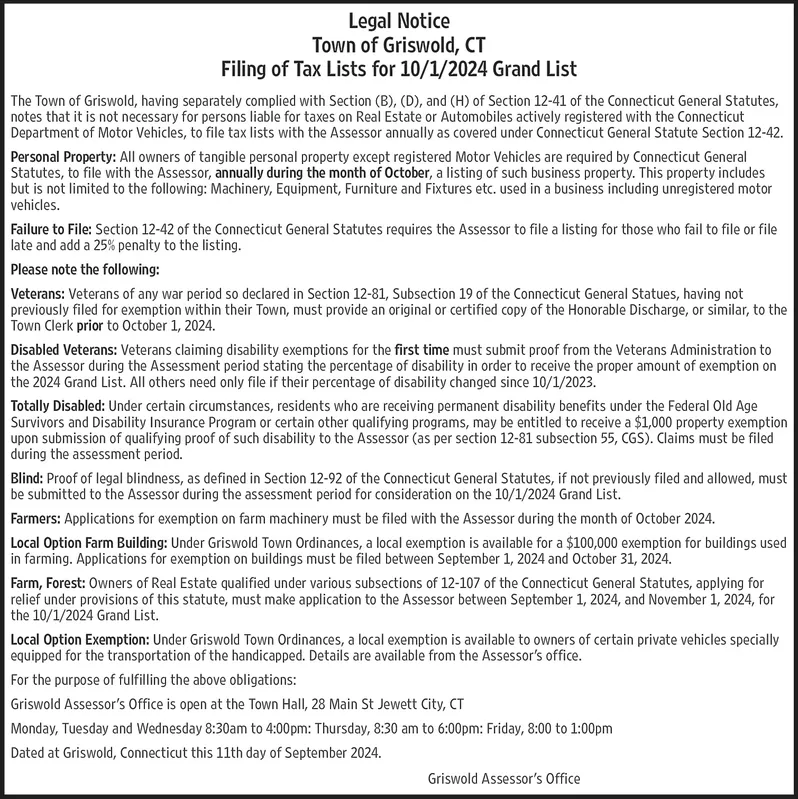

Legal Notice Town of Griswold, CT Filing of Tax Lists for 10/1/2024 Grand List The Town of Griswold, having separately complied with Section (B), (D), and (H) of Section 12-41 of the Connecticut General Statutes, notes that it is not necessary for persons liable for taxes on Real Estate or Automobiles actively registered with the Connecticut Department of Motor Vehicles, to file tax lists with the Assessor annually as covered under Connecticut General Statute Section 12-42. Personal Property: All owners of tangible personal property except registered Motor Vehicles are required by Connecticut General Statutes, to file with the Assessor, annually during the month of October, a listing of such business property. This property includes but is not limited to the following: Machinery, Equipment, Furniture and Fixtures etc. used in a business including unregistered motor vehicles. Failure to File: Section 12-42 of the Connecticut General Statutes requires the Assessor to file a listing for those who fail to file or file late and add a 25% penalty to the listing. Please note the following: Veterans: Veterans of any war period so declared in Section 12-81, Subsection 19 of the Connecticut General Statues, having not previously filed for exemption within their Town, must provide an original or certified copy of the Honorable Discharge, or similar, to the Town Clerk prior to October 1, 2024. Disabled Veterans: Veterans claiming disability exemptions for the first time must submit proof from the Veterans Administration to the Assessor during the Assessment period stating the percentage of disability in order to receive the proper amount of exemption on the 2024 Grand List. All others need only file if their percentage of disability changed since 10/1/2023. Totally Disabled: Under certain circumstances, residents who are receiving permanent disability benefits under the Federal Old Age Survivors and Disability Insurance Program or certain other qualifying programs, may be entitled to receive a $1,000 property exemption upon submission of qualifying proof of such disability to the Assessor (as per section 12-81 subsection 55, CGS). Claims must be filed during the assessment period. Blind: Proof of legal blindness, as defined in Section 12-92 of the Connecticut General Statutes, if not previously filed and allowed, must be submitted to the Assessor during the assessment period for consideration on the 10/1/2024 Grand List. Farmers: Applications for exemption on farm machinery must be filed with the Assessor during the month of October 2024. Local Option Farm Building: Under Griswold Town Ordinances, a local exemption is available for a $100,000 exemption for buildings used in farming. Applications for exemption on buildings must be filed between September 1, 2024 and October 31, 2024. Farm, Forest: Owners of Real Estate qualified under various subsections of 12-107 of the Connecticut General Statutes, applying for relief under provisions of this statute, must make application to the Assessor between September 1, 2024, and November 1, 2024, for the 10/1/2024 Grand List. Local Option Exemption: Under Griswold Town Ordinances, a local exemption is available to owners of certain private vehicles specially equipped for the transportation of the handicapped. Details are available from the Assessor's office. For the purpose of fulfilling the above obligations: Griswold Assessor's Office is open at the Town Hall, 28 Main St Jewett City, CT Monday, Tuesday and Wednesday 8:30am to 4:00pm: Thursday, 8:30 am to 6:00pm: Friday, 8:00 to 1:00pm Dated at Griswold, Connecticut this 11th day of September 2024. Griswold Assessor's Office Legal Notice Town of Griswold , CT Filing of Tax Lists for 10/1/2024 Grand List The Town of Griswold , having separately complied with Section ( B ) , ( D ) , and ( H ) of Section 12-41 of the Connecticut General Statutes , notes that it is not necessary for persons liable for taxes on Real Estate or Automobiles actively registered with the Connecticut Department of Motor Vehicles , to file tax lists with the Assessor annually as covered under Connecticut General Statute Section 12-42 . Personal Property : All owners of tangible personal property except registered Motor Vehicles are required by Connecticut General Statutes , to file with the Assessor , annually during the month of October , a listing of such business property . This property includes but is not limited to the following : Machinery , Equipment , Furniture and Fixtures etc. used in a business including unregistered motor vehicles . Failure to File : Section 12-42 of the Connecticut General Statutes requires the Assessor to file a listing for those who fail to file or file late and add a 25 % penalty to the listing . Please note the following : Veterans : Veterans of any war period so declared in Section 12-81 , Subsection 19 of the Connecticut General Statues , having not previously filed for exemption within their Town , must provide an original or certified copy of the Honorable Discharge , or similar , to the Town Clerk prior to October 1 , 2024 . Disabled Veterans : Veterans claiming disability exemptions for the first time must submit proof from the Veterans Administration to the Assessor during the Assessment period stating the percentage of disability in order to receive the proper amount of exemption on the 2024 Grand List . All others need only file if their percentage of disability changed since 10/1/2023 . Totally Disabled : Under certain circumstances , residents who are receiving permanent disability benefits under the Federal Old Age Survivors and Disability Insurance Program or certain other qualifying programs , may be entitled to receive a $ 1,000 property exemption upon submission of qualifying proof of such disability to the Assessor ( as per section 12-81 subsection 55 , CGS ) . Claims must be filed during the assessment period . Blind : Proof of legal blindness , as defined in Section 12-92 of the Connecticut General Statutes , if not previously filed and allowed , must be submitted to the Assessor during the assessment period for consideration on the 10/1/2024 Grand List . Farmers : Applications for exemption on farm machinery must be filed with the Assessor during the month of October 2024 . Local Option Farm Building : Under Griswold Town Ordinances , a local exemption is available for a $ 100,000 exemption for buildings used in farming . Applications for exemption on buildings must be filed between September 1 , 2024 and October 31 , 2024 . Farm , Forest : Owners of Real Estate qualified under various subsections of 12-107 of the Connecticut General Statutes , applying for relief under provisions of this statute , must make application to the Assessor between September 1 , 2024 , and November 1 , 2024 , for the 10/1/2024 Grand List . Local Option Exemption : Under Griswold Town Ordinances , a local exemption is available to owners of certain private vehicles specially equipped for the transportation of the handicapped . Details are available from the Assessor's office . For the purpose of fulfilling the above obligations : Griswold Assessor's Office is open at the Town Hall , 28 Main St Jewett City , CT Monday , Tuesday and Wednesday 8:30 am to 4:00 pm : Thursday , 8:30 am to 6:00 pm : Friday , 8:00 to 1:00 pm Dated at Griswold , Connecticut this 11th day of September 2024 . Griswold Assessor's Office