Advertisement

-

Published Date

March 27, 2022This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

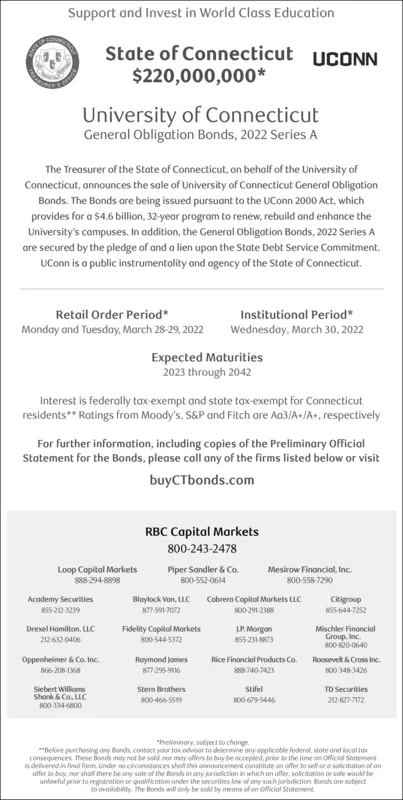

Support and Invest in World Class Education State of Connecticut $220,000,000* UCONN University of Connecticut General Obligation Bonds, 2022 Series A The Treasurer of the State of Connecticut, on behalf of the University of Connecticut, announces the sale of University of Connecticut General Obligation Bonds. The Bonds are being issued pursuant to the UConn 2000 Act, which provides for a $4.6 billion, 32-year program to renew, rebuild and enhance the University's campuses. In addition, the General Obligotion Bonds, 2022 Series A are secured by the pledge of and a lien upon the State Debt Service Commitment. UConn is a public instrumentality and ogency of the Stote of Connecticut. Retail Order Period* Institutional Period* Monday and Tuesday, March 28-29, 2022 Wednesday, March 30, 2022 Expected Maturities 2023 through 2042 Interest is federally tax-exempt and state tax-exempt for Connecticut residents** Ratings from Moody's, S&P and Fitch are Aa3/A+/A+, respectively For further information, including copies of the Preliminary Official Statement for the Bonds, please call any of the firms listed below or visit buyCTbonds.com RBC Capital Markets 800-243-2478 Loop Copital Markets 888294-8898 Mesirow Financiol, Inc. Piper Sandler & Co. 800-552-0614 800-558-7290 Acodemy Securities Blaylock Van, LLC Cobrero Copital Morkets LLC 800 291-2388 Citigroup 855-20-1219 877-591-7072 855-644-7252 Drexel Homilton, LLC LP. Morgan Fidelity Copital Markets s00 5445372 Mischler Finonciol Group, Inc. 800-K20-0640 212 632-0406 855 231 8873 Roymond james 877-295 916 Rice Financial Products Co. Roosevelt & Cross Inc. S88 740 7423 Oppenheimer & Co. Inc. 866-208 1368 800 348 3426 Siebert Willioms Shonk & Co. LLC 800-134-800 Stern Brothers Stifel TD Securities 800 6795446 212 827-7172 800-466 559 "Preliminary, subject to change *"Before purchosing ony Bonds, contoct your tox odvisor to determine any applicable federal. stote and local tax consequences. These Bonds may not be sold nor moy offers to buy be acepted, prior to the time an Official Stotement is delvered in finol form. Lnder no circumdances shol thes announcement constitute on offer to sell or e solicitation of an offer to buy, nor shal there be ony sole of the Bonds in ony jurisdiction in which on offer, solicitotion or sale would be unlowful prior to registrotion or qualiicobion under the securities low of any such jurisdiction Bonds are subject to avoilobility. the Bonds will only be sold by meons of on Officiol Stotement. Support and Invest in World Class Education State of Connecticut $220,000,000* UCONN University of Connecticut General Obligation Bonds, 2022 Series A The Treasurer of the State of Connecticut, on behalf of the University of Connecticut, announces the sale of University of Connecticut General Obligation Bonds. The Bonds are being issued pursuant to the UConn 2000 Act, which provides for a $4.6 billion, 32-year program to renew, rebuild and enhance the University's campuses. In addition, the General Obligotion Bonds, 2022 Series A are secured by the pledge of and a lien upon the State Debt Service Commitment. UConn is a public instrumentality and ogency of the Stote of Connecticut. Retail Order Period* Institutional Period* Monday and Tuesday, March 28-29, 2022 Wednesday, March 30, 2022 Expected Maturities 2023 through 2042 Interest is federally tax-exempt and state tax-exempt for Connecticut residents** Ratings from Moody's, S&P and Fitch are Aa3/A+/A+, respectively For further information, including copies of the Preliminary Official Statement for the Bonds, please call any of the firms listed below or visit buyCTbonds.com RBC Capital Markets 800-243-2478 Loop Copital Markets 888294-8898 Mesirow Financiol, Inc. Piper Sandler & Co. 800-552-0614 800-558-7290 Acodemy Securities Blaylock Van, LLC Cobrero Copital Morkets LLC 800 291-2388 Citigroup 855-20-1219 877-591-7072 855-644-7252 Drexel Homilton, LLC LP. Morgan Fidelity Copital Markets s00 5445372 Mischler Finonciol Group, Inc. 800-K20-0640 212 632-0406 855 231 8873 Roymond james 877-295 916 Rice Financial Products Co. Roosevelt & Cross Inc. S88 740 7423 Oppenheimer & Co. Inc. 866-208 1368 800 348 3426 Siebert Willioms Shonk & Co. LLC 800-134-800 Stern Brothers Stifel TD Securities 800 6795446 212 827-7172 800-466 559 "Preliminary, subject to change *"Before purchosing ony Bonds, contoct your tox odvisor to determine any applicable federal. stote and local tax consequences. These Bonds may not be sold nor moy offers to buy be acepted, prior to the time an Official Stotement is delvered in finol form. Lnder no circumdances shol thes announcement constitute on offer to sell or e solicitation of an offer to buy, nor shal there be ony sole of the Bonds in ony jurisdiction in which on offer, solicitotion or sale would be unlowful prior to registrotion or qualiicobion under the securities low of any such jurisdiction Bonds are subject to avoilobility. the Bonds will only be sold by meons of on Officiol Stotement.