Advertisement

-

Published Date

March 15, 2025This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

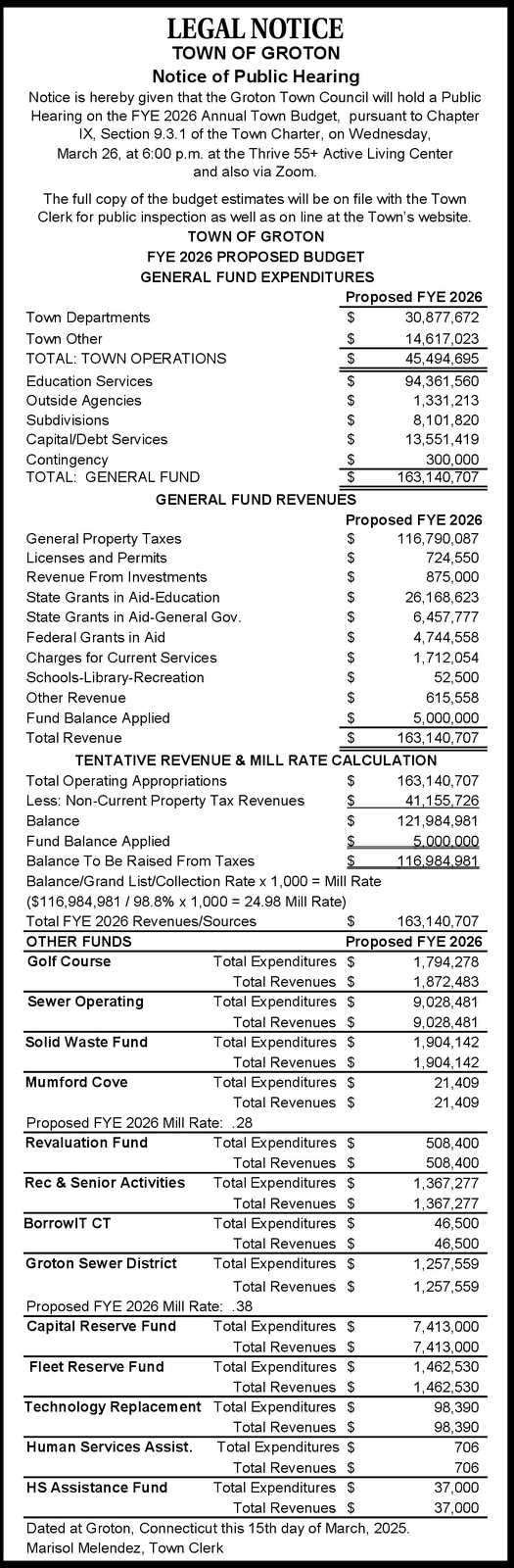

LEGAL NOTICE TOWN OF GROTON Notice of Public Hearing Notice is hereby given that the Groton Town Council will hold a Public Hearing on the FYE 2026 Annual Town Budget, pursuant to Chapter IX, Section 9.3.1 of the Town Charter, on Wednesday, March 26, at 6:00 p.m. at the Thrive 55+ Active Living Center and also via Zoom. The full copy of the budget estimates will be on file with the Town Clerk for public inspection as well as on line at the Town's website. TOWN OF GROTON FYE 2026 PROPOSED BUDGET GENERAL FUND EXPENDITURES Proposed FYE 2026 Town Departments $ 30,877,672 Town Other $ 14,617,023 TOTAL: TOWN OPERATIONS $ 45,494,695 Education Services $ 94,361,560 Outside Agencies 1,331,213 Subdivisions $ 8,101,820 Capital/Debt Services $ 13,551,419 Contingency $ 300,000 TOTAL: GENERAL FUND $ 163,140,707 GENERAL FUND REVENUES Proposed FYE 2026 General Property Taxes $ 116,790,087 Licenses and Permits $ 724,550 Revenue From Investments $ 875,000 State Grants in Aid-Education $ 26,168,623 State Grants in Aid-General Gov. $ 6,457,777 Federal Grants in Aid $ 4,744,558 Charges for Current Services $ 1,712,054 Schools-Library-Recreation $ 52,500 Other Revenue 615,558 Fund Balance Applied $ 5,000,000 Total Revenue $ 163,140,707 TENTATIVE REVENUE & MILL RATE CALCULATION Total Operating Appropriations $ 163,140,707 Less: Non-Current Property Tax Revenues $ 41,155,726 Balance $ 121,984,981 Fund Balance Applied 5,000,000 Balance To Be Raised From Taxes 116,984.981 Balance/Grand List/Collection Rate x 1,000 = Mill Rate ($116,984,981/98.8% x 1,000 = 24.98 Mill Rate) Total FYE 2026 Revenues/Sources $ 163,140,707 OTHER FUNDS Proposed FYE 2026 Golf Course Total Expenditures $ 1,794,278 Total Revenues $ 1,872,483 Sewer Operating Total Expenditures $ 9,028,481 Total Revenues $ 9,028,481 Solid Waste Fund Total Expenditures $ 1,904,142 Total Revenues $ 1,904,142 Mumford Cove Total Expenditures $ 21,409 Total Revenues $ 21,409 Proposed FYE 2026 Mill Rate: .28 Revaluation Fund Total Expenditures $ 508,400 Total Revenues $ 508,400 Rec & Senior Activities Total Expenditures $ 1,367,277 Total Revenues $ 1,367,277 BorrowIT CT Total Expenditures $ 46,500 Groton Sewer District Total Revenues $ Total Expenditures $ 46,500 1,257,559 Total Revenues $ 1,257,559 Proposed FYE 2026 Mill Rate: Capital Reserve Fund .38 Total Expenditures $ 7,413,000 Total Revenues $ 7,413,000 Fleet Reserve Fund Total Expenditures $ 1,462,530 Total Revenues $ 1,462,530 Technology Replacement Total Expenditures $ 98,390 Total Revenues $ 98,390 Human Services Assist. Total Expenditures $ 706 Total Revenues $ 706 HS Assistance Fund Total Expenditures $ 37,000 Total Revenues $ 37,000 Dated at Groton, Connecticut this 15th day of March, 2025. Marisol Melendez, Town Clerk LEGAL NOTICE TOWN OF GROTON Notice of Public Hearing Notice is hereby given that the Groton Town Council will hold a Public Hearing on the FYE 2026 Annual Town Budget , pursuant to Chapter IX , Section 9.3.1 of the Town Charter , on Wednesday , March 26 , at 6:00 p.m. at the Thrive 55+ Active Living Center and also via Zoom . The full copy of the budget estimates will be on file with the Town Clerk for public inspection as well as on line at the Town's website . TOWN OF GROTON FYE 2026 PROPOSED BUDGET GENERAL FUND EXPENDITURES Proposed FYE 2026 Town Departments $ 30,877,672 Town Other $ 14,617,023 TOTAL : TOWN OPERATIONS $ 45,494,695 Education Services $ 94,361,560 Outside Agencies 1,331,213 Subdivisions $ 8,101,820 Capital / Debt Services $ 13,551,419 Contingency $ 300,000 TOTAL : GENERAL FUND $ 163,140,707 GENERAL FUND REVENUES Proposed FYE 2026 General Property Taxes $ 116,790,087 Licenses and Permits $ 724,550 Revenue From Investments $ 875,000 State Grants in Aid - Education $ 26,168,623 State Grants in Aid - General Gov. $ 6,457,777 Federal Grants in Aid $ 4,744,558 Charges for Current Services $ 1,712,054 Schools - Library - Recreation $ 52,500 Other Revenue 615,558 Fund Balance Applied $ 5,000,000 Total Revenue $ 163,140,707 TENTATIVE REVENUE & MILL RATE CALCULATION Total Operating Appropriations $ 163,140,707 Less : Non - Current Property Tax Revenues $ 41,155,726 Balance $ 121,984,981 Fund Balance Applied 5,000,000 Balance To Be Raised From Taxes 116,984.981 Balance / Grand List / Collection Rate x 1,000 = Mill Rate ( $ 116,984,981 / 98.8 % x 1,000 = 24.98 Mill Rate ) Total FYE 2026 Revenues / Sources $ 163,140,707 OTHER FUNDS Proposed FYE 2026 Golf Course Total Expenditures $ 1,794,278 Total Revenues $ 1,872,483 Sewer Operating Total Expenditures $ 9,028,481 Total Revenues $ 9,028,481 Solid Waste Fund Total Expenditures $ 1,904,142 Total Revenues $ 1,904,142 Mumford Cove Total Expenditures $ 21,409 Total Revenues $ 21,409 Proposed FYE 2026 Mill Rate : .28 Revaluation Fund Total Expenditures $ 508,400 Total Revenues $ 508,400 Rec & Senior Activities Total Expenditures $ 1,367,277 Total Revenues $ 1,367,277 BorrowIT CT Total Expenditures $ 46,500 Groton Sewer District Total Revenues $ Total Expenditures $ 46,500 1,257,559 Total Revenues $ 1,257,559 Proposed FYE 2026 Mill Rate : Capital Reserve Fund .38 Total Expenditures $ 7,413,000 Total Revenues $ 7,413,000 Fleet Reserve Fund Total Expenditures $ 1,462,530 Total Revenues $ 1,462,530 Technology Replacement Total Expenditures $ 98,390 Total Revenues $ 98,390 Human Services Assist . Total Expenditures $ 706 Total Revenues $ 706 HS Assistance Fund Total Expenditures $ 37,000 Total Revenues $ 37,000 Dated at Groton , Connecticut this 15th day of March , 2025 . Marisol Melendez , Town Clerk