Advertisement

-

Published Date

March 19, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

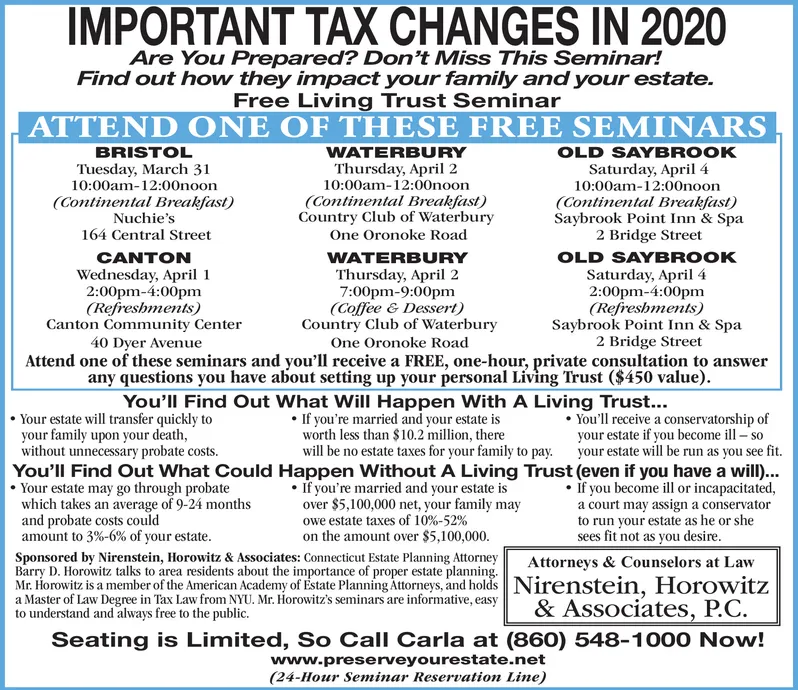

IMPORTANT TAX CHANGES IN 2020 Are You Prepared? Don't Miss This Seminar! Find out how they impact your family and your estate. Free Living Trust Seminar ATTEND SEMINARS ONE OF THESE FREE WATERBURY Thursday, April 2 10:00am-12:00noon (Continental Breakfast) Country Club of Waterbury One Oronoke Road BRISTOL Tuesday, March 31 10:00am-12:00noon OLD SAYBROOK Saturday, April 4 10:00am-12:00noon (Continental Breakfast) Saybrook Point Inn & Spa 2 Bridge Street (Continental Breakfast) Nuchie's 164 Central Street CANTON WATERBURY Thursday, April 2 7:00pm-9:00pm (Coffee & Dessert) Country Club of Waterbury OLD SAYBROOK Wednesday, April 1 2:00pm-4:00pm (Refreshments) Canton Community Center 40 Dyer Avenue Saturday, April4 2:00pm-4:00pm (Refreshments) Saybrook Point Inn & Spa 2 Bridge Street One Oronoke Road Attend one of these seminars and you'll receive a FREE, one-hour, private consultation to answer any questions you have about setting up your personal Living Trust ($450 value). Your estate will transfer quickly to your family upon your death, without unnecessary probate costs. You'll Find Out What Will Happen With A Living Trust... If you're married and your estate is worth less than $10.2 million, there will be no estate taxes for your family to pay. You'll receive a conservatorship of your estate if you become ill- so your estate will be run as you see fit. You'll Find Out What Could Happen Without A Living Trust (even if you have a will.. If you're married and your estate is over $5,100,000 net, your family may owe estate taxes of 10%-52% on the amount over $5,100,000. Your estate may go through probate which takes an average of 9-24 months and probate costs could amount to 3%-6% of your estate. Sponsored by Nirenstein, Horowitz & Associates: Connecticut Estate Planning Attorney Barry D. Horowitz talks to area residents about the importance of proper estate planning. if you become ill or incapacitated, a court may assign a conservator to run your estate as he or she sees fit not as you desire. Attorneys & Counselors at Law Mr. Horowitz is a member of the American Academy of Estate Planning Attorneys, and holds Nirenstein, Horowitz a Master of Law Degree in Tax Law from NYU. Mr. Horowitz's seminars are informative, easy to understand and always free to the public. & Associates, P.C. Seating is Limited, So Call Carla at (860) 548-1000 Now! www.preserveyourestate.net (24-Hour Seminar Reservation Line) IMPORTANT TAX CHANGES IN 2020 Are You Prepared? Don't Miss This Seminar! Find out how they impact your family and your estate. Free Living Trust Seminar ATTEND SEMINARS ONE OF THESE FREE WATERBURY Thursday, April 2 10:00am-12:00noon (Continental Breakfast) Country Club of Waterbury One Oronoke Road BRISTOL Tuesday, March 31 10:00am-12:00noon OLD SAYBROOK Saturday, April 4 10:00am-12:00noon (Continental Breakfast) Saybrook Point Inn & Spa 2 Bridge Street (Continental Breakfast) Nuchie's 164 Central Street CANTON WATERBURY Thursday, April 2 7:00pm-9:00pm (Coffee & Dessert) Country Club of Waterbury OLD SAYBROOK Wednesday, April 1 2:00pm-4:00pm (Refreshments) Canton Community Center 40 Dyer Avenue Saturday, April4 2:00pm-4:00pm (Refreshments) Saybrook Point Inn & Spa 2 Bridge Street One Oronoke Road Attend one of these seminars and you'll receive a FREE, one-hour, private consultation to answer any questions you have about setting up your personal Living Trust ($450 value). Your estate will transfer quickly to your family upon your death, without unnecessary probate costs. You'll Find Out What Will Happen With A Living Trust... If you're married and your estate is worth less than $10.2 million, there will be no estate taxes for your family to pay. You'll receive a conservatorship of your estate if you become ill- so your estate will be run as you see fit. You'll Find Out What Could Happen Without A Living Trust (even if you have a will.. If you're married and your estate is over $5,100,000 net, your family may owe estate taxes of 10%-52% on the amount over $5,100,000. Your estate may go through probate which takes an average of 9-24 months and probate costs could amount to 3%-6% of your estate. Sponsored by Nirenstein, Horowitz & Associates: Connecticut Estate Planning Attorney Barry D. Horowitz talks to area residents about the importance of proper estate planning. if you become ill or incapacitated, a court may assign a conservator to run your estate as he or she sees fit not as you desire. Attorneys & Counselors at Law Mr. Horowitz is a member of the American Academy of Estate Planning Attorneys, and holds Nirenstein, Horowitz a Master of Law Degree in Tax Law from NYU. Mr. Horowitz's seminars are informative, easy to understand and always free to the public. & Associates, P.C. Seating is Limited, So Call Carla at (860) 548-1000 Now! www.preserveyourestate.net (24-Hour Seminar Reservation Line)