Advertisement

-

Published Date

May 9, 2025This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

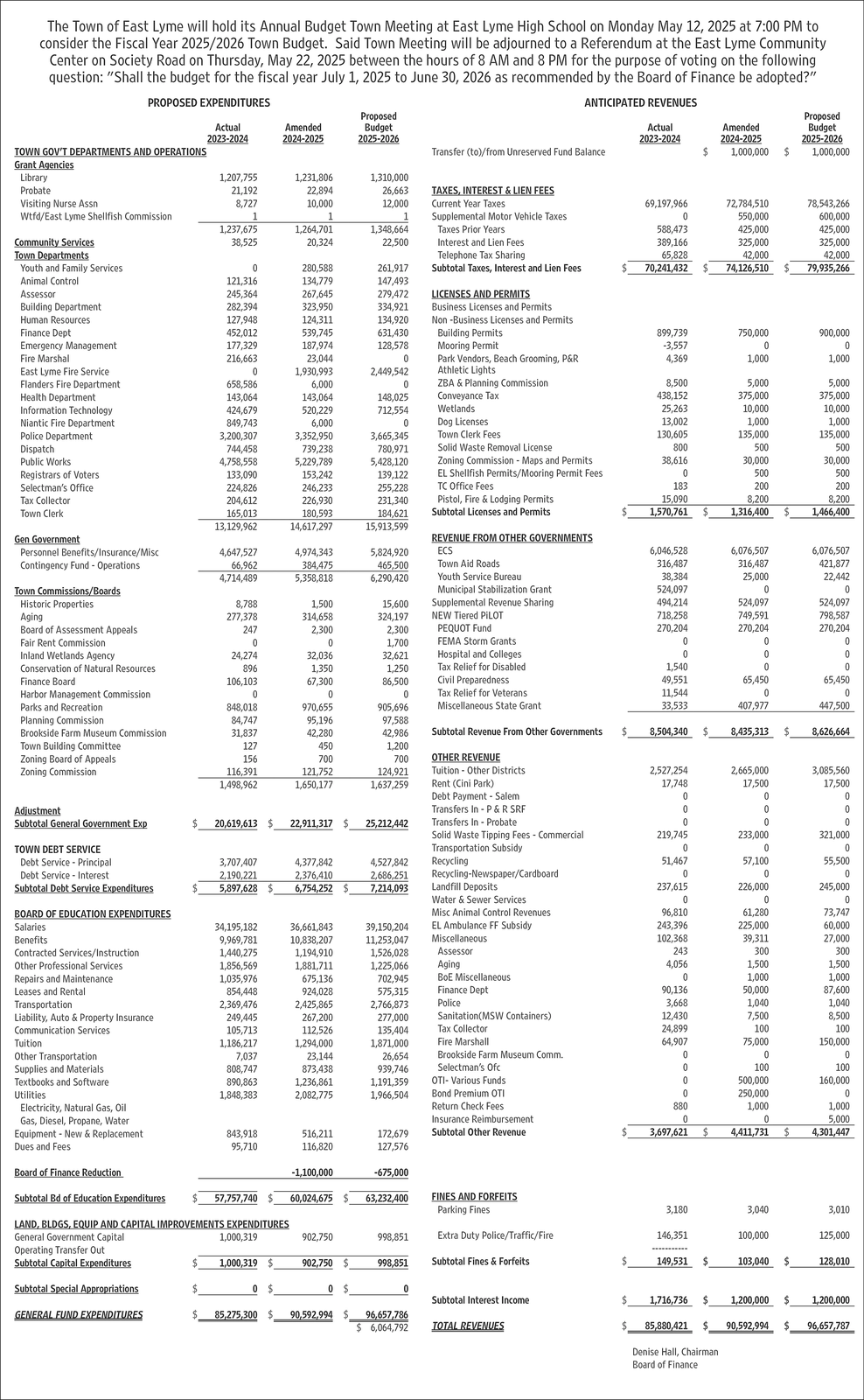

The Town of East Lyme will hold its Annual Budget Town Meeting at East Lyme High School on Monday May 12, 2025 at 7:00 PM to consider the Fiscal Year 2025/2026 Town Budget. Said Town Meeting will be adjourned to a Referendum at the East Lyme Community Center on Society Road on Thursday, May 22, 2025 between the hours of 8 AM and 8 PM for the purpose of voting on the following question: "Shall the budget for the fiscal year July 1, 2025 to June 30, 2026 as recommended by the Board of Finance be adopted?" PROPOSED EXPENDITURES Proposed ANTICIPATED REVENUES Actual 2023-2024 Amended 2024-2025 Proposed Budget 2025-2026 Actual 2023-2024 Amended TOWN GOV'T DEPARTMENTS AND OPERATIONS Transfer (to)/from Unreserved Fund Balance $ 2024-2025 1,000,000 Budget 2025-2026 S 1,000,000 Grant Agencies Library Probate 1,207,755 21,192 1,231,806 1,310,000 Visiting Nurse Assn Wtfd/East Lyme Shellfish Commission 8,727 1 22,894 10,000 26,663 TAXES, INTEREST & LIEN FEES 12,000 Current Year Taxes 69,197,966 72,784,510 78,543,266 Supplemental Motor Vehicle Taxes 0 550,000 600,000 1,237,675 1,264,701 1,348,664 Taxes Prior Years 588,473 425,000 425,000 Community Services 38,525 20,324 22,500 Interest and Lien Fees 389,166 325,000 325,000 Town Departments Telephone Tax Sharing 65,828 42,000 42,000 Youth and Family Services 0 280,588 261,917 Subtotal Taxes, Interest and Lien Fees 70,241,432 74,126,510 79,935,266 Animal Control 121,316 134,779 147,493 Assessor 245,364 267,645 279,472 LICENSES AND PERMITS Building Department 282,394 323,950 334,921 Business Licenses and Permits Human Resources 127,948 124,311 134,920 Non-Business Licenses and Permits Finance Dept 452,012 539,745 631,430 Building Permits 899,739 750,000 900,000 Emergency Management 177,329 187,974 128,578 Mooring Permit -3,557 0 0 Fire Marshal 216,663 23,044 0 Park Vendors, Beach Grooming, P&R 4,369 1,000 1,000 East Lyme Fire Service 0 1,930,993 2,449,542 Athletic Lights Flanders Fire Department 658,586 6,000 0 ZBA & Planning Commission 8.500 5,000 5,000 Health Department 143,064 143,064 Information Technology 424,679 520.229 148,025 712,554 Conveyance Tax 438,152 375,000 375,000 Niantic Fire Department 849,743 6,000 0 Wetlands Dog Licenses 25,263 10,000 10,000 13,002 1,000 1,000 Police Department 3,200,307 3,352,950 3,665,345 Town Clerk Fees 130,605 135,000 135,000 Dispatch 744,458 739,238 780,971 Solid Waste Removal License 800 500 500 Public Works 4,758,558 5,229,789 5,428,120 Zoning Commission - Maps and Permits 38,616 30,000 30,000 Registrars of Voters 133,090 153,242 139,122 EL Shellfish Permits/Mooring Permit Fees 0 500 500 Selectman's Office 224,826 246,233 255,228 TC Office Fees 183 200 200 Tax Collector 204,612 226,930 231,340 Pistol, Fire & Lodging Permits 15,090 8,200 8,200 Town Clerk 165,013 180,593 184,621 Subtotal Licenses and Permits 1,570,761 1,316,400 1,466,400 13,129,962 14,617,297 15,913,599 Gen Government REVENUE FROM OTHER GOVERNMENTS Personnel Benefits/Insurance/Misc 4,647,527 Contingency Fund - Operations 66,962 4,714,489 4,974,343 384,475 5,358,818 5,824,920 465,500 6,290,420 ECS 6,046,528 6,076,507 6,076,507 Town Aid Roads 316,487 316,487 421,877 Youth Service Bureau 38,384 25,000 22,442 Town Commissions/Boards Municipal Stabilization Grant 524,097 0 0 Historic Properties 8,788 Aging 277,378 1,500 314,658 15,600 Supplemental Revenue Sharing 494,214 524,097 524,097 324,197 NEW Tiered PILOT 718,258 749,591 798,587 Board of Assessment Appeals 247 2,300 2,300 PEQUOT Fund 270,204 270,204 270,204 Fair Rent Commission 0 0 1,700 FEMA Storm Grants 0 0 0 Inland Wetlands Agency 24,274 32,036 32,621 Hospital and Colleges 0 0 0 Conservation of Natural Resources 896 1,350 1,250 Finance Board 106,103 67,300 86,500 Tax Relief for Disabled Civil Preparedness 1,540 0 0 49,551 65,450 65,450 Harbor Management Commission 0 0 0 Tax Relief for Veterans 11,544 Parks and Recreation 848,018 970,655 905,696 Miscellaneous State Grant 33,533 0 407,977 0 447,500 Planning Commission 84,747 95,196 97,588 Brookside Farm Museum Commission 31,837 42,280 42,986 Subtotal Revenue From Other Governments $ 8,504,340 $ 8,435,313 $ 8,626,664 Town Building Committee 127 Zoning Board of Appeals 156 450 700 1,200 700 OTHER REVENUE Zoning Commission 116,391 1,498,962 121,752 1,650,177 124,921 1,637,259 Tuition - Other Districts 2,527,254 2,665,000 3,085,560 Rent (Cini Park) 17,748 17,500 17,500 Debt Payment Salem 0 0 0 Adjustment Transfers In- P&R SRF 0 0 0 Subtotal General Government Exp $ 20,619,613 $ 22,911,317 $ 25,212,442 Transfers In Probate 0 0 0 TOWN DEBT SERVICE Solid Waste Tipping Fees - Commercial Transportation Subsidy 219,745 233,000 321,000 0 0 0 Debt Service Principal 3,707,407 Debt Service - Interest 2,190,221 4,377,842 2,376,410 4,527,842 Recycling 51,467 57,100 55.500 2,686,251 Recycling-Newspaper/Cardboard 0 0 0 Subtotal Debt Service Expenditures 5,897,628 $ 6,754,252 $ 7,214,093 Landfill Deposits 237,615 226,000 245,000 Water & Sewer Services 0 0 0 BOARD OF EDUCATION EXPENDITURES Misc Animal Control Revenues 96,810 61,280 73,747 Salaries 34,195,182 36,661,843 39.150.204 EL Ambulance FF Subsidy 243,396 225,000 60,000 Benefits 9,969,781 10,838,207 11,253,047 Miscellaneous 102,368 39,311 27,000 Contracted Services/Instruction 1,440,275 1,194,910 1,526,028 Assessor 243 300 300 Other Professional Services 1,856,569 1,881,711 1,225,066 Aging 4,056 1,500 1,500 Repairs and Maintenance 1,035,976 675,136 702.945 BoE Miscellaneous 0 1,000 1,000 Leases and Rental 854,448 924,028 575,315 Finance Dept 90,136 50,000 87,600 Transportation 2,369,476 2,425,865 2,766,873 Police 3,668 1,040 1,040 Liability, Auto & Property Insurance 249,445 Communication Services 105,713 Tuition 1,186,217 267,200 112,526 1,294,000 277,000 Sanitation (MSW Containers) 12,430 7,500 8,500 Other Transportation 7,037 Supplies and Materials 808,747 Textbooks and Software 890,863 Utilities 1,848,383 23,144 873,438 1,236,861 2,082,775 135,404 1,871,000 26,654 939,746 1,191,359 1,966,504 Tax Collector 24,899 100 Fire Marshall 64,907 75,000 100 150,000 Brookside Farm Museum Comm. 0 0 Selectman's Ofc 0 100 OTI- Various Funds 0 500,000 0 100 160,000 Bond Premium OTI 0 250,000 0 Electricity, Natural Gas, Oil Return Check Fees 880 1,000 1,000 Gas, Diesel, Propane, Water Equipment - New & Replacement 843,918 Dues and Fees 95,710 516,211 116,820 172,679 Insurance Reimbursement Subtotal Other Revenue 0 0 5,000 3,697,621 4,411,731 4,301,447 127,576 Board of Finance Reduction -1,100,000 -675,000 Subtotal Bd of Education Expenditures 57,757,740 60,024,675 63,232,400 FINES AND FORFEITS Parking Fines LAND, BLDGS, EQUIP AND CAPITAL IMPROVEMENTS EXPENDITURES General Government Capital 1,000,319 902,750 998,851 Extra Duty Police/Traffic/Fire Operating Transfer Out Subtotal Capital Expenditures 1,000,319 $ 902,750 $ 998,851 Subtotal Fines & Forfeits 3,180 3,040 3,010 146,351 100.000 125,000 149,531 103,040 $ 128,010 Subtotal Special Appropriations $ 0 $ 0 $ Subtotal Interest Income $ 1,716,736 $ 1,200,000 S 1,200,000 GENERAL FUND EXPENDITURES $ 85,275,300 $ 90,592,994 $ 96,657,786 $ 6,064,792 TOTAL REVENUES $ 85,880,421 $ 90,592,994 $ 96,657,787 Denise Hall, Chairman Board of Finance The Town of East Lyme will hold its Annual Budget Town Meeting at East Lyme High School on Monday May 12 , 2025 at 7:00 PM to consider the Fiscal Year 2025/2026 Town Budget . Said Town Meeting will be adjourned to a Referendum at the East Lyme Community Center on Society Road on Thursday , May 22 , 2025 between the hours of 8 AM and 8 PM for the purpose of voting on the following question : " Shall the budget for the fiscal year July 1 , 2025 to June 30 , 2026 as recommended by the Board of Finance be adopted ? " PROPOSED EXPENDITURES Proposed ANTICIPATED REVENUES Actual 2023-2024 Amended 2024-2025 Proposed Budget 2025-2026 Actual 2023-2024 Amended TOWN GOV'T DEPARTMENTS AND OPERATIONS Transfer ( to ) / from Unreserved Fund Balance $ 2024-2025 1,000,000 Budget 2025-2026 S 1,000,000 Grant Agencies Library Probate 1,207,755 21,192 1,231,806 1,310,000 Visiting Nurse Assn Wtfd / East Lyme Shellfish Commission 8,727 1 22,894 10,000 26,663 TAXES , INTEREST & LIEN FEES 12,000 Current Year Taxes 69,197,966 72,784,510 78,543,266 Supplemental Motor Vehicle Taxes 0 550,000 600,000 1,237,675 1,264,701 1,348,664 Taxes Prior Years 588,473 425,000 425,000 Community Services 38,525 20,324 22,500 Interest and Lien Fees 389,166 325,000 325,000 Town Departments Telephone Tax Sharing 65,828 42,000 42,000 Youth and Family Services 0 280,588 261,917 Subtotal Taxes , Interest and Lien Fees 70,241,432 74,126,510 79,935,266 Animal Control 121,316 134,779 147,493 Assessor 245,364 267,645 279,472 LICENSES AND PERMITS Building Department 282,394 323,950 334,921 Business Licenses and Permits Human Resources 127,948 124,311 134,920 Non - Business Licenses and Permits Finance Dept 452,012 539,745 631,430 Building Permits 899,739 750,000 900,000 Emergency Management 177,329 187,974 128,578 Mooring Permit -3,557 0 0 Fire Marshal 216,663 23,044 0 Park Vendors , Beach Grooming , P & R 4,369 1,000 1,000 East Lyme Fire Service 0 1,930,993 2,449,542 Athletic Lights Flanders Fire Department 658,586 6,000 0 ZBA & Planning Commission 8.500 5,000 5,000 Health Department 143,064 143,064 Information Technology 424,679 520.229 148,025 712,554 Conveyance Tax 438,152 375,000 375,000 Niantic Fire Department 849,743 6,000 0 Wetlands Dog Licenses 25,263 10,000 10,000 13,002 1,000 1,000 Police Department 3,200,307 3,352,950 3,665,345 Town Clerk Fees 130,605 135,000 135,000 Dispatch 744,458 739,238 780,971 Solid Waste Removal License 800 500 500 Public Works 4,758,558 5,229,789 5,428,120 Zoning Commission - Maps and Permits 38,616 30,000 30,000 Registrars of Voters 133,090 153,242 139,122 EL Shellfish Permits / Mooring Permit Fees 0 500 500 Selectman's Office 224,826 246,233 255,228 TC Office Fees 183 200 200 Tax Collector 204,612 226,930 231,340 Pistol , Fire & Lodging Permits 15,090 8,200 8,200 Town Clerk 165,013 180,593 184,621 Subtotal Licenses and Permits 1,570,761 1,316,400 1,466,400 13,129,962 14,617,297 15,913,599 Gen Government REVENUE FROM OTHER GOVERNMENTS Personnel Benefits / Insurance / Misc 4,647,527 Contingency Fund - Operations 66,962 4,714,489 4,974,343 384,475 5,358,818 5,824,920 465,500 6,290,420 ECS 6,046,528 6,076,507 6,076,507 Town Aid Roads 316,487 316,487 421,877 Youth Service Bureau 38,384 25,000 22,442 Town Commissions / Boards Municipal Stabilization Grant 524,097 0 0 Historic Properties 8,788 Aging 277,378 1,500 314,658 15,600 Supplemental Revenue Sharing 494,214 524,097 524,097 324,197 NEW Tiered PILOT 718,258 749,591 798,587 Board of Assessment Appeals 247 2,300 2,300 PEQUOT Fund 270,204 270,204 270,204 Fair Rent Commission 0 0 1,700 FEMA Storm Grants 0 0 0 Inland Wetlands Agency 24,274 32,036 32,621 Hospital and Colleges 0 0 0 Conservation of Natural Resources 896 1,350 1,250 Finance Board 106,103 67,300 86,500 Tax Relief for Disabled Civil Preparedness 1,540 0 0 49,551 65,450 65,450 Harbor Management Commission 0 0 0 Tax Relief for Veterans 11,544 Parks and Recreation 848,018 970,655 905,696 Miscellaneous State Grant 33,533 0 407,977 0 447,500 Planning Commission 84,747 95,196 97,588 Brookside Farm Museum Commission 31,837 42,280 42,986 Subtotal Revenue From Other Governments $ 8,504,340 $ 8,435,313 $ 8,626,664 Town Building Committee 127 Zoning Board of Appeals 156 450 700 1,200 700 OTHER REVENUE Zoning Commission 116,391 1,498,962 121,752 1,650,177 124,921 1,637,259 Tuition - Other Districts 2,527,254 2,665,000 3,085,560 Rent ( Cini Park ) 17,748 17,500 17,500 Debt Payment Salem 0 0 0 Adjustment Transfers In- P & R SRF 0 0 0 Subtotal General Government Exp $ 20,619,613 $ 22,911,317 $ 25,212,442 Transfers In Probate 0 0 0 TOWN DEBT SERVICE Solid Waste Tipping Fees - Commercial Transportation Subsidy 219,745 233,000 321,000 0 0 0 Debt Service Principal 3,707,407 Debt Service - Interest 2,190,221 4,377,842 2,376,410 4,527,842 Recycling 51,467 57,100 55.500 2,686,251 Recycling - Newspaper / Cardboard 0 0 0 Subtotal Debt Service Expenditures 5,897,628 $ 6,754,252 $ 7,214,093 Landfill Deposits 237,615 226,000 245,000 Water & Sewer Services 0 0 0 BOARD OF EDUCATION EXPENDITURES Misc Animal Control Revenues 96,810 61,280 73,747 Salaries 34,195,182 36,661,843 39.150.204 EL Ambulance FF Subsidy 243,396 225,000 60,000 Benefits 9,969,781 10,838,207 11,253,047 Miscellaneous 102,368 39,311 27,000 Contracted Services / Instruction 1,440,275 1,194,910 1,526,028 Assessor 243 300 300 Other Professional Services 1,856,569 1,881,711 1,225,066 Aging 4,056 1,500 1,500 Repairs and Maintenance 1,035,976 675,136 702.945 BoE Miscellaneous 0 1,000 1,000 Leases and Rental 854,448 924,028 575,315 Finance Dept 90,136 50,000 87,600 Transportation 2,369,476 2,425,865 2,766,873 Police 3,668 1,040 1,040 Liability , Auto & Property Insurance 249,445 Communication Services 105,713 Tuition 1,186,217 267,200 112,526 1,294,000 277,000 Sanitation ( MSW Containers ) 12,430 7,500 8,500 Other Transportation 7,037 Supplies and Materials 808,747 Textbooks and Software 890,863 Utilities 1,848,383 23,144 873,438 1,236,861 2,082,775 135,404 1,871,000 26,654 939,746 1,191,359 1,966,504 Tax Collector 24,899 100 Fire Marshall 64,907 75,000 100 150,000 Brookside Farm Museum Comm . 0 0 Selectman's Ofc 0 100 OTI- Various Funds 0 500,000 0 100 160,000 Bond Premium OTI 0 250,000 0 Electricity , Natural Gas , Oil Return Check Fees 880 1,000 1,000 Gas , Diesel , Propane , Water Equipment - New & Replacement 843,918 Dues and Fees 95,710 516,211 116,820 172,679 Insurance Reimbursement Subtotal Other Revenue 0 0 5,000 3,697,621 4,411,731 4,301,447 127,576 Board of Finance Reduction -1,100,000 -675,000 Subtotal Bd of Education Expenditures 57,757,740 60,024,675 63,232,400 FINES AND FORFEITS Parking Fines LAND , BLDGS , EQUIP AND CAPITAL IMPROVEMENTS EXPENDITURES General Government Capital 1,000,319 902,750 998,851 Extra Duty Police / Traffic / Fire Operating Transfer Out Subtotal Capital Expenditures 1,000,319 $ 902,750 $ 998,851 Subtotal Fines & Forfeits 3,180 3,040 3,010 146,351 100.000 125,000 149,531 103,040 $ 128,010 Subtotal Special Appropriations $ 0 $ 0 $ Subtotal Interest Income $ 1,716,736 $ 1,200,000 S 1,200,000 GENERAL FUND EXPENDITURES $ 85,275,300 $ 90,592,994 $ 96,657,786 $ 6,064,792 TOTAL REVENUES $ 85,880,421 $ 90,592,994 $ 96,657,787 Denise Hall , Chairman Board of Finance